CEO´s opinion

Forecasting raw material market prices

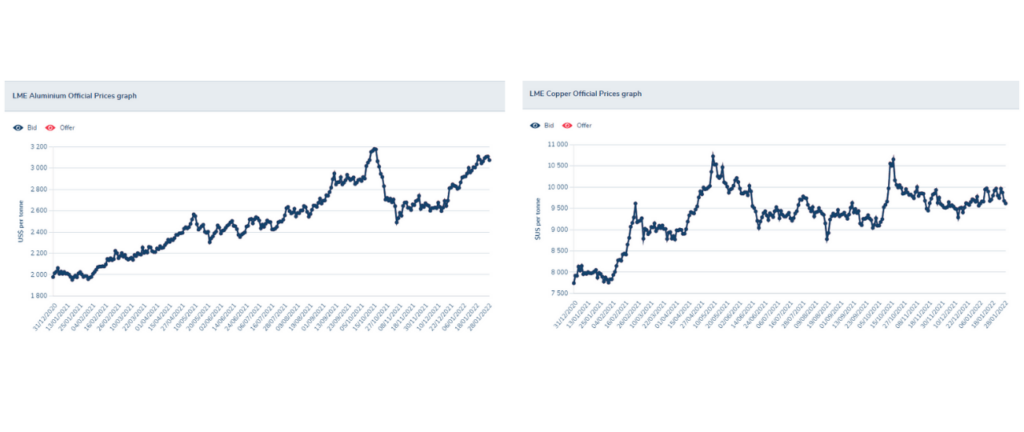

If I had been asked to forecast the market price of aluminium two years ago, I would never have been able to guess that the price trend would be so drastic. Purchase prices for plastic, copper and packaging materials have also soared. It is also concerning that the price of transport containers is five times higher than only a year ago.

Is forecasting price developments any clearer today in a situation where geopolitical tensions are causing market uncertainty? I would say no, it remains difficult to predict the development of raw material prices. Of course, we hope that the cost pressures will be temporary, but the market has not yet shown signs of stabilization or a clear downward signal. For the demand of aluminium, I can predict that it will increase further, due to, among other things, the production of electric cars.

How can we control costs?

A small company cannot measurably influence world market prices for raw materials and producers ’premiums’, so our position is indeed unfortunate. Increased costs for materials and premiums must be transferred to our sales price to some extent.

However, we have taken all the measures possible to reduce this impact:

- A more efficient production line has been opened

- The supply chain is optimized

- The packaging of the products has been rationalized

- Material loss is minimized.

How can we work together so that costs do not get out of hand completely? Our sphere of influence is the improvement of packaging and the consideration of lighting track lengths to reduce freight and packaging costs.

We’d like to hear your ideas, to achieve more together.